Can the Chinese Infant Formula Market Keep Growing?

Last year 130 million babies were born. 1 Of those, more than 16 million began their lives in one country. 2

The sheer size of China’s population – 1.3 billion 3 – and its birth rate represent obvious opportunities for infant formula manufacturers.

Almost 800,000 metric tons of formula are sold in the country each year (compared to 147,000in the US, 87,000 in France, and68,000 in the UK.). 4

While 12% of new babies in the world are Chinese, the country accounts for a whopping 40% of the global retail market for infant formula. 5

Why? In part because Chinese culture values babies extremely highly – financially as well as emotionally. In some respects this is a legacy of the country’s one-child policy, which was introduced in the seventies in an attempt to curb population growth. As one commentator has put it, the Chinese parent greatly values his solitary child because of the “major investment” and “national resource” that he or she represents. 6 It follows then that significant amounts of money are devoted to children –families invest between nine and 11 per cent of their income on their offspring, much of it on formula.

Parents of a child aged between 13 months and two years spend an average of 844 RMB (€113) on infant formula every month. 7

Parents of a child aged between 13 months and two years spend an average of 844 RMB (€113) on infant formula every month. 7

But it’s not just parents who look after the children – another clue to the importance of formula. There’s a popular saying in China that “it takes six adults to raise one child” reflecting the importance of the role played by other family members, particularly grandparents.

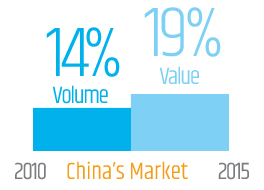

China’s infant formula market is not only one of the world’s largest, but also one of the fastest growing. Between 2010 and 2015, it increased by 14% in volume, and by 19% in value. 8 There are no signs of this trend abating and a number of reasons to expect it to continue.

China’s infant formula market is not only one of the world’s largest, but also one of the fastest growing. Between 2010 and 2015, it increased by 14% in volume, and by 19% in value. 8 There are no signs of this trend abating and a number of reasons to expect it to continue.

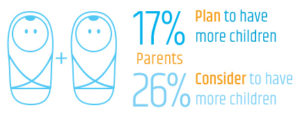

Last year, the country’s single child policy became a two-child policy – 17% of parents now plan to have more children, and 26% are considering it. 9

Moreover, the urbanisation of China in recent years has led to greater numbers of women entering the workforce. Disposable income and minimum wages are growing. 10

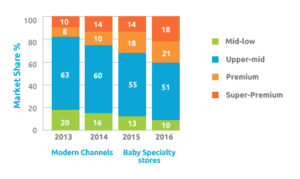

Such shifts are also impacting on the kind of infant formula that people are buying, with parents increasingly demanding both high nutritional value and premium products. In 2013, super-premium products accounted for 14% of the formula sold in Chinese baby specialty stores. By 2014 that had grown to 18%. 11

And when it comes to quality, there is one definite ‘Must Have’. OPO is the fastest growing premium ingredient in the Chinese infant formula market. It enables manufacturers to create infant formula with a fat composition that is closer than ever to breast milk in terms of structure. The clinically tested benefits of OPO – for healthy growth, comfort and well-being – are well known in China, far better than anywhere else in the world.

Therefore, there is every reason to be optimistic about the future. But manufacturers would be wise to pay attention not just to the size of the market, but also to the growing importance that Chinese parents are placing on premium ingredients. Infant formula companies who include INFAT® OPO in their products can use a compelling and scientifically-proven marketing proposition in association with their brands.

Figure 1: Premium Products represent a growing share of the Infant Formula Market (Source: Synutra, International Investor presentation, May, 2015)

1.World Health Organization, WHO Safe Childbirth Checklist, Accessed 16 June 2016, http://www.who.int/patientsafety/implementation/checklists/childbirth/en/

2.National Bureau of Statistics of China, China’s Economy Realized a Moderate but Stable and Sound Growth in 2015, 19 January 2016 http://www.stats.gov.cn/english/PressRelease/201601/t20160119_1306072.html

3.National Bureau of Statistics of China, China’s Economy Realized a Moderate but Stable and Sound Growth in 2015, 19 January 2016 http://www.stats.gov.cn/english/PressRelease/201601/t20160119_1306072.html

4.Euromonitor 2015

5.Euromonitor 2015

6.Jenkins, Alexis Chinese Culture and Parenting, Livestrong, 25 May 2015, http://www.livestrong.com/article/239128-chinese-culture-parenting/

7.CBME China Children Baby Maternity Products Industry Consumer Research Report 2014, October 2014

8.Euromonitor 2015

9.CBME China Children Baby Maternity Products Industry Consumer Research Report 2014, October 2014

10.National Bureau of Statistics of China China’s Economy Showed Good Momentum of Steady Growth in the Year of 2013, 20 January 2014, http://www.stats.gov.cn/english/Pressrelease/201401/t20140120_502079.htm

11.Synutra, International Investor presentation, May, 2015

Back to Blog