Eight Facts About the Chinese Infant Formula Market

In Chinese numerology, eight is the luckiest number. In Cantonese, it sounds similar to the words for both “wealth” and “fortune”. The Beijing Olympics opened on 8/8/08 at 8 seconds and 8 minutes past 8pm. And in 2003, a phone number made up entirely of eights was sold for over a quarter of a million dollars to Sichuan airlines.

So, when we decided to write a blog about the unique features of the Chinese formula market, it seemed only right to ofer you eight key facts:

1. It’s the only formula market in the world with over 2000 brands

The Chinese formula market is currently the busiest in the world, with over 2000 brands competing. However, that’s all set to change. New regulations are forcing integration and life is becoming harder for smaller companies. By 2018, the number of brands is expected to fall to around 500.

E-Share Industrial Info Centre, ‘80 percent of infant formula brands to be eliminated in China’

2. Quality is the most important driver of consumer choice

High competition has not led to a scenario where brand matters more – instead properties that relate to quality are more important. The two most important factors driving choice of product are health benefits and safety. That’s why consumers want the benefit of sn2 palmitate (OPO), for example, and are seeking out products that contain high quality ingredients

High competition has not led to a scenario where brand matters more – instead properties that relate to quality are more important. The two most important factors driving choice of product are health benefits and safety. That’s why consumers want the benefit of sn2 palmitate (OPO), for example, and are seeking out products that contain high quality ingredients

3. It includes large premium and super – premium segments

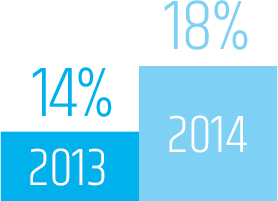

The value that Chinese consumers place on quality ingredients such as OPO has created a distinct hierarchy in the formula market. There are not only premium products, but also super-premium products. And the super-premium segment is growing – in 2013, it accounted for 14% of the formula sold in Chinese baby specialty stores. By 2014 that had grown to 18%.

Super premium

In Chinese baby specialty stores

4. Prices are higher than in many other countries

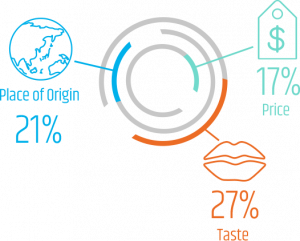

The emphasis on quality means that consumers in China are willing to pay more for formula. Price is considered an important driver of product choice by only 17% of consumers, and ranks lower even than considerations such as place of origin, raw materials and taste.

Drivers of product choice

Price is a minor factor

CBME China Children Baby Maternity Products Industry Consumer Research Report 2014,

October 2014

5. Local Vs Global Brands

Local Vs Global Brands is a key battle in recent years, importers in Australia and New Zealand in particular have recognized the potential of the market, and benefited from high levels of trust in overseas brands. However, new import regulations have begun affecting their profits

6. E-commerce is increasingly important

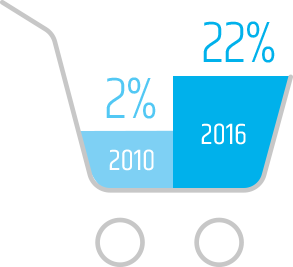

E-Commerce is increasingly popular in China, with consumers enjoying the convenience it offers. Many manufacturers make it possible to trace the formula they sell online, which provides a guarantee against fake products. As a result, online sales are growing – they represented 22% of the market 2015, up from around 2% in 2010.

Craymer, Lucy, ‘Chinese Head to the Web to Buy Imported

Baby Formula’, Wall Street Journal, Aug 2, 2016

7.The relaxation of the Single Child Policy is cause for optimism

This year, the shift from the decades-old single child policy to a two-child policy has sparked a mini baby boom. We expect this to lead to further growth in the formula market.

8. Consumers are extremely knowledgeable about ingredients

The Chinese not only want their children to be as healthy and comfortable as possible, but are also extremely well informed about the quality of formula ingredients. They know far more, for example, about the benefit of OPO (such as INFAT® OPO) than consumers elsewhere.